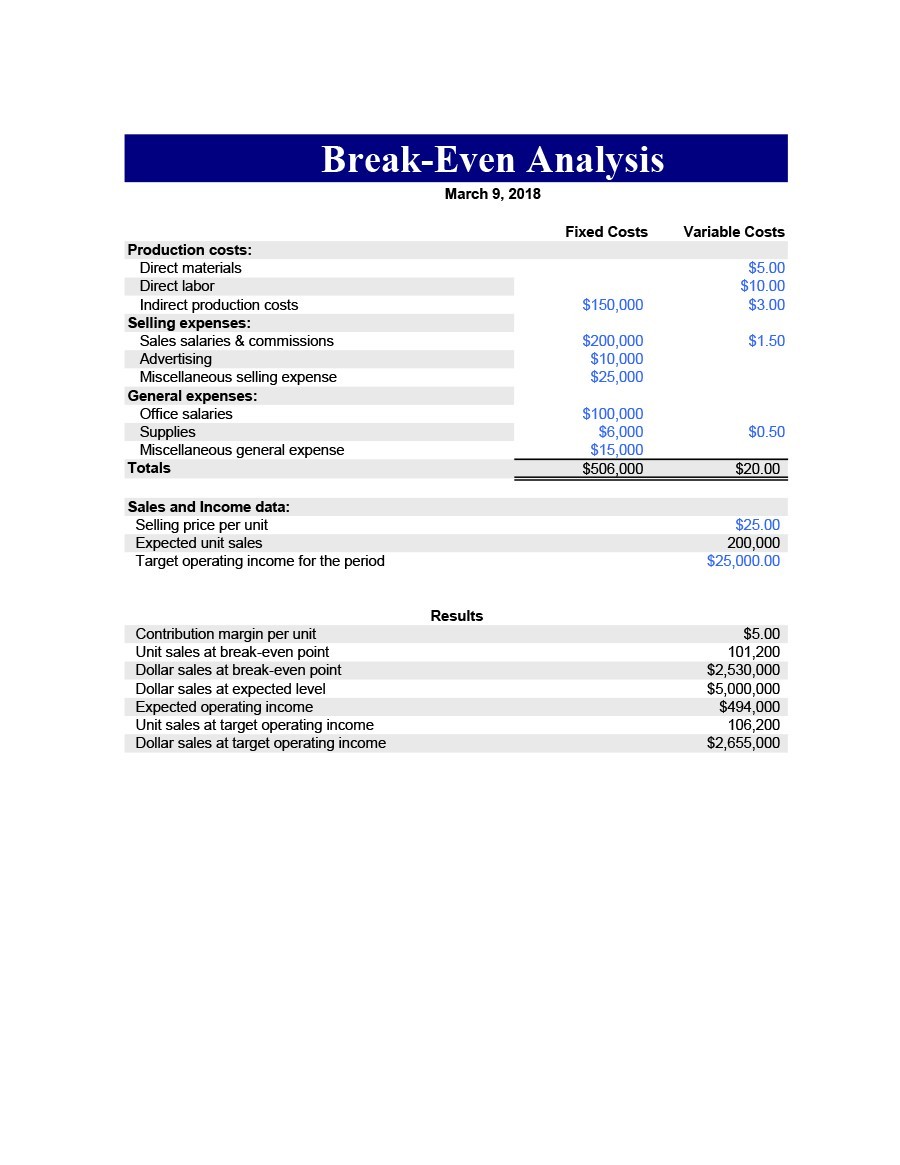

Can you offer enough making your break-even volume? This is a timeless company chart that assists you consider your fundamental monetary truths. The illustration reveals that the business has to available around 1,222 devices in order to cross the break-even line. If approximating and balancing is challenging, utilize your earnings and loss table to compute a working repaired expense price quote, it will be a rough price quote, however it will offer a beneficial input for a conservative Breakeven Analysis. This will offer you a much better understanding on monetary truths. Rather, we advise that you utilize your routine running taken care of expenses, consisting of payroll and typical costs (overall regular monthly operating costs). Technically, a break-even analysis specifies taken care of expenses as expenses that would continue even if you went broke.

It does not examine how need might be influenced at various cost levels. Example computations listed below program how break-even analysis is used.īreakeven Analysis is a supply-side analysis that is, it just assesses the expenses of the sales.

The Break-even Analysis table computes a break-even point based upon taken care of expenses, variable expenses per system of sales, and income per device of sales.īreak-even analysis is main to this understanding. Illustration 1 reveals the Breakeven Analysis table from Business Plan Pro. The Break-even Analysis lets you identify exactly what you have to offer, regular monthly or every year, to cover your expenses of working, your break-even point. – Annual financial obligation service (overall month-to-month financial obligation payments for the year).Here are the variables had to calculate a break-even sales analysis: One helpful tool in tracking your company’s capital is a Breakeven Analysis It’s a relatively basic computation and can show extremely practical in choosing whether making a devices purchase or in understanding how close you are to your break-even level. It is based upon categorizing production expenses in between those which are “variable” (expenses that alter when the production output modifications) and those that are “repaired” (expenses not straight associated to the volume of production). It is very important to recognize your start-up expenses, which will assist you identify your sales earnings had to pay continuous overhead.īreak-even analysis is a method extensively utilized by production management and management accounting professionals. When your company will be able to cover all its expenditures and start to make revenue, breakeven analysis is utilized to identify.

This computation is important for any company owner, since the breakeven point is the lower limitation of revenue when identifying margins. If you can precisely anticipate your sales and expenses, performing a breakeven analysis is a matter of easy mathematics. – It depends upon balancing your per-unit variable expense and per-unit profits over the entire company. Rather, you might desire to utilize your routine running taken care of expenses, consisting of payroll and typical expenditures. Technically, a Breakeven Analysis specifies repaired expenses as those expenses that would continue even if you went broke.

0 kommentar(er)

0 kommentar(er)